Five weeks after the first case of a novel coronavirus (2019-nCoV) was reported to the World Health Organisation, the virus continues to spread rapidly in mainland China with increasing incidences in other countries. While 2019-nCoV appears, in many ways, to be less severe than previous coronavirus outbreaks, the scale of infections has triggered policy and business decisions that could have significant impact on higher education. Of note, Wuhan, the epicentre of the outbreak, is the world’s second largest host of HE students, behind only Guangzhou, with almost a million students studying at the city’s 83 HEIs (including 46 universities and 37 higher vocational colleges). As travel restrictions have expanded to cover the whole of mainland China, risks to international education and student mobility are rising.

While there’s still a lot we don’t know about the epidemic and how policymakers will react to it, we have compiled the following thoughts on how the virus might impact the UK higher education this year and some possible near-term responses.

What are the risks to our activities?

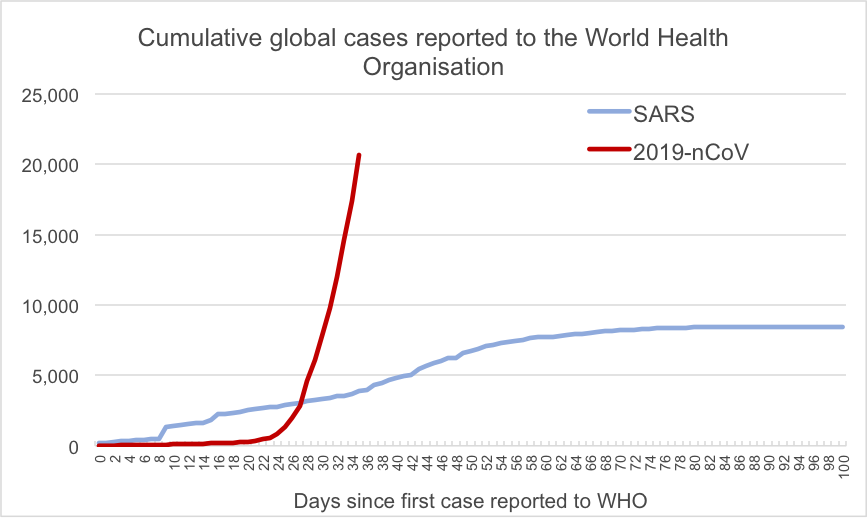

The primary risks to international education stem from travel restrictions and the economic impact of the virus. The first thing to understand is what has driven the strong reactions from governments and business around the world: issues of scale. While the 2019 coronavirus outbreak currently appears to have a much lower mortality rate than the 2002-2003 SARS epidemic (approximately 2 per cent vs. 10 per cent, respectively), the large and growing number of infections has prompted governments and businesses to take decisive action. As the chart below shows, the number of cases is still rising rapidly with no signs of tapering off yet, so the extent of the epidemic is still an open question.

Data source: World Health Organization, Novel Coronavirus situation reports

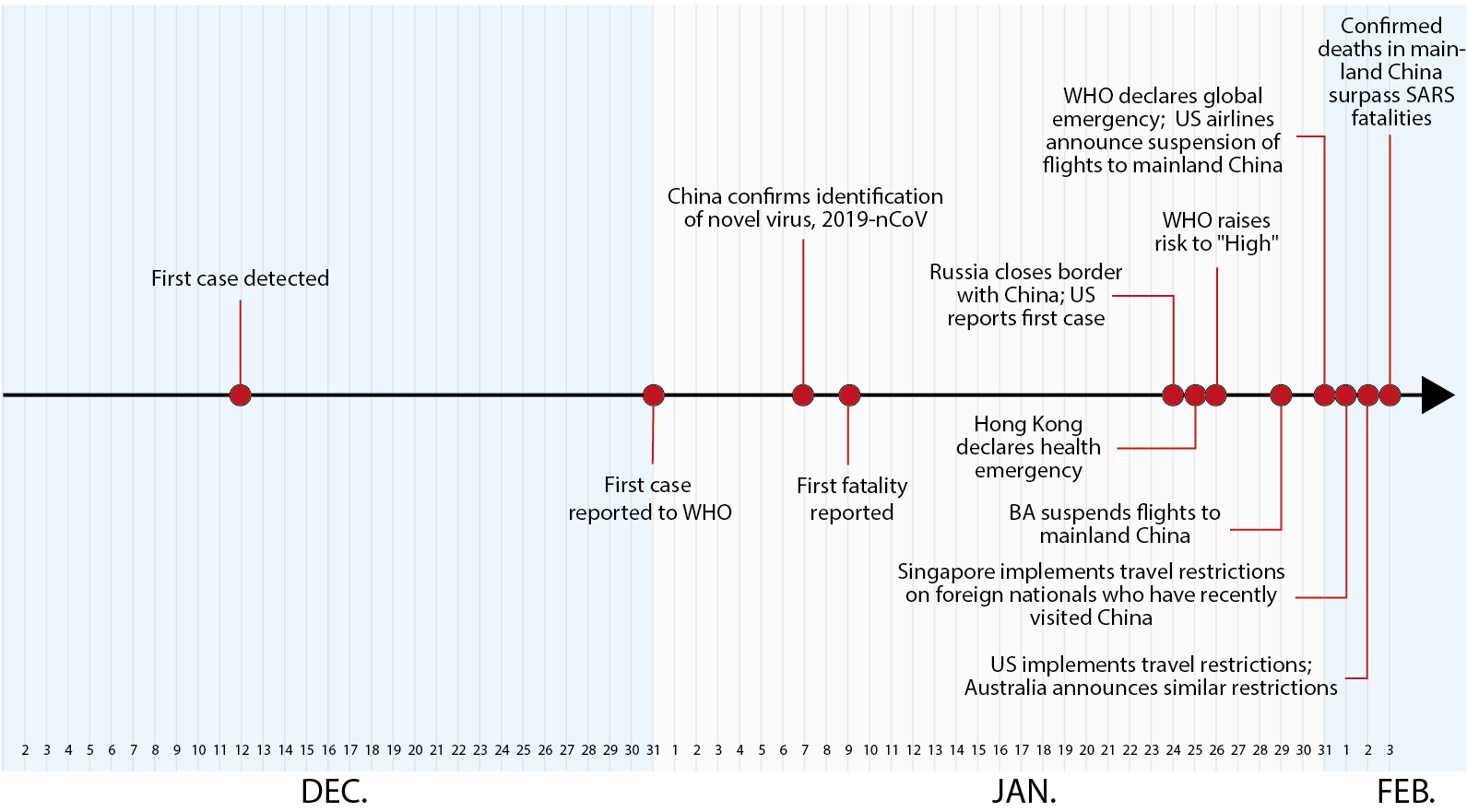

Although the WHO has advised against travel restrictions and the cancellation of transportation links, a number of governments have prohibited foreign nationals who have recently travelled to China from entry, while major airlines have cancelled flights to mainland China (see timeline below). The continuation or expansion of barriers to travel are the primary risk to both 2020-21 international enrolments and our broader exchange and partnership activities. As discussed further below, the baseline case that many multinational businesses seem to be operating under is that the epidemic will be under control by the end of March, and the major US airlines have accordingly suspended flights through this point.

Timeline of key policy and business responses to 2019-nCoV

Source: Various reports compiled by British Council

Perhaps the most important question is the extent to which the virus will spread beyond China’s borders. Indeed, one of the concerns for policymakers is how much more connected China is with the world than it was during the SARS outbreak. Based on China’s official figures, its annual number of outbound tourists grew by 800 per cent from the SARS era to 2018.

So far, however, the spread of the virus outside of China has been slow. As of 5 February, only 159 cases (less than 1 per cent of the total) and 1 fatality have been reported outside of the mainland. Just 49 cases of possible human-to-human transmission have been reported outside of mainland China and major disruptions to travel and economic activities have not spread beyond Hong Kong and Macau.

The wider economic impacts of the virus are difficult to gauge at this point. The Chinese government will undoubtedly work to mitigate the effects on the broader economy and households through stimulus packages. A weakening of the renminbi to boost Chinese exports is also a likely response.

Even if the effect on annual economic growth turns out to be slight, much like in the case of SARS, we will probably see a more severe impact on households that derive incomes from affected industries, particularly travel, logistics, manufacturing and luxury goods. Regional economies that are reliant on Chinese tourism are likely to also feel the squeeze. Although China’s relatively high savings rates will help insulate households from the shock, a prolonged crisis may impact many individual overseas study plans.

What are the likely scenarios for UK HE?

Over the past week we have reached out to our network of corporate, academic and education agent networks to gather a rough consensus view on likely scenarios for return to normal operations in mainland China. In the table below we have summarised and expanded these inputs as best as possible. This is not the result of a scientific poll nor should it be taken as any form of official guidance. The purpose is instead to start a discussion with the sector about possible scenarios that can be refined to a more comprehensive consensus view over the coming weeks.

Scenario for return to normal business activity | Impact on UK HE sector | Possible complications |

Optimistic: End of February | Minimal |

|

Baseline: End of March | Moderate |

|

Pessimistic: End June | High |

|

Worst case: End August or later | Severe |

|

Supporting our Chinese students and partners

This is an exceptionally challenging time for students and our HE partners in China. Aside from the disruptions to life and travel, and separation from family and friends that millions of Chinese are facing, the crisis has also unfortunately given rise to isolated yet highly visible demonstrations of anti-Chinese sentiments overseas. It is therefore more important than ever that we as a sector demonstrate our commitment to the UK-China relationship. A failure to do so could jeopardize Chinese student experience in the UK and raise longer-term risks to our attractiveness as a study destination.

In our discussions over the past week, a few concrete ideas have emerged for how we can support Chinese students and proactively manage the challenges related to the virus on our campuses. Here are our highlights:

- Determine how flexible your institution can be about accommodating late arrivals, alternate entry points or remote learning. In the worst-case scenario, we need contingency plans for a spike in demand for January intakes.

- Extend application deadlines where possible. Many IELTS test takers will be delayed in sitting a test and subsequently sending their IELTS scores to institutions. (IELTS partners will look to increase capacity as soon as testing restarts.)

- Closely monitor the sentiments and reactions of non-Chinese students on campus and engage accordingly.

- Meet Chinese students on their own social media turf. During this time WeChat may be the most effective medium for communicating.

- Help students in China fill the gap in study by offering free or discounted short-term online certificate courses.

What to watch

The situation is evolving rapidly and much of what is written here may be out of date within days. To keep abreast of relevant developments, there are four things we recommend that the sector monitors:

- FCO travel advice – this should be your first port of call for information and advice about travel considerations and policy responses to the epidemic.

- WHO daily reports of nCoV cases, particularly outside of China.

- Extensions or expansions of travel restrictions by the other major study destinations.

- Further delays to key Chinese exam dates or the academic calendar – e.g., the second phase of China’s postgraduate admissions process has been delayed and is not yet rescheduled.

- For further developments in IELTS test arrangements, please see: https://www.ielts.org/news/2020/changes-to-ielts-test-arrangements-in-some-locations-due-to-novel-coronavirus.1

1 All IELTS and IELTS for UKVI tests are currently suspended in Mainland China (until 1st March), Hong Kong SAR (until 17th Feb) and Macau SAR (until 11th Feb):

Add new comment

Please note that comments by non-members are moderated. They do not appear on the site until they have been approved. Comments by registered members appear here immediately. Your email address will not be published. All fields are required.