Header image © James Glossop

The Home Office released Q3 visa data on 1 December, giving us our first clear view of inbound student mobility trends in 2016. Overall study visa issuance receded slightly, down 0.2 per cent compared to the first three quarters of 2015. Among the UK’s top ten non-EU recruitment markets, only three saw year-on-year growth in study visa issuance.

Top 10 countries by issued Tier 4 and equivalent visas (main applicants), Q1-Q3 2016

| Tier 4 & equivalent visas issued, Q1-Q3 2016 (January-September) | Growth vs same period last year | |

| China | 72,819 | +8.7% |

| United States | 11,974 | -0.1% |

| India | 9,744 | +0.9% |

| Hong Kong | 8,477 | -1.4% |

| Malaysia | 7,275 | -14.4% |

| Nigeria | 4,698 | -31.8% |

| Thailand | 4,135 | -1.2% |

| Korea (South) | 3,568 | +2.6% |

| Saudi Arabia | 3,532 | -11.5% |

| Canada | 2,980 | -3.3% |

| Worldwide Total | 178,650 | -0.2% |

Source: Home Office. Note: numbers refer to Main Applicants only, i.e. excluding dependents

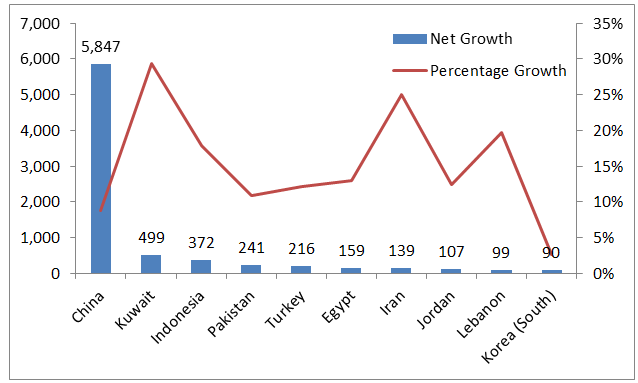

As in previous years, Mainland China was by far the largest student source in 2016, and also accounted for the largest net growth. The number of visas issued to Chinese students increased by 8.7 per cent to reach over 72,800 in the first three quarters of the year, up more than 5,800 over the same period in 2015. This increase is more than ten times higher than the country with the next largest growth.

Top 10 countries by net growth in Tier 4 and equivalent visas issued to main applicants, Q1-Q3 2016 vs Q1-Q3 2015

Source: Home Office.

There was also some positive news from another very important student recruitment market, South Asia. The region returned to positive growth, with visa issuances up 1.4 per cent after six straight years of precipitous decline. Pakistan and India both saw an increase in student visa numbers, while the rate of decline in Bangladeshi students slowed significantly. Yet while this is a welcome development, the number of students from this region is still far below the number seen just a few years ago, and the UK is still losing market share – 1.4 per cent growth is far below what competitor study destinations have achieved in recent years.

As the chart above shows, a number of Middle Eastern countries saw strong growth in visas issued in 2016. However, other countries in the region saw a major drop, particularly Saudi Arabia and Oman, due to cuts in government scholarships linked to faltering oil revenue.

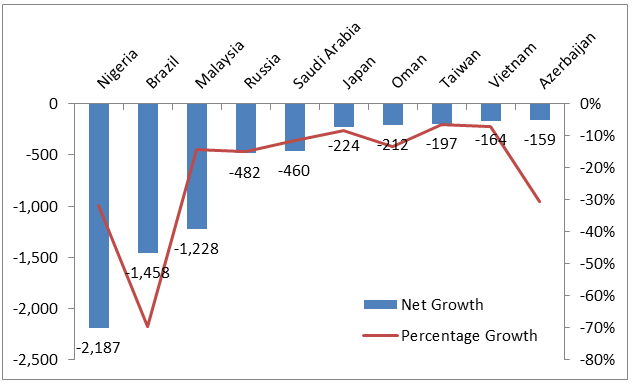

Other East Asian countries are also a mixed bag. Aside from China, Indonesia also saw very strong growth, while the number of visas issued to students from South Korea also increased. But all seven other major East Asian sending markets saw a drop in visa issuances. In some cases this drop was very large – in Malaysia, the 5th largest sending country overall, the number of visas issued fell by more than 14 per cent, likely due to that country’s recent economic difficulties. Japan, Taiwan, Singapore and Vietnam all saw declines of over 5 per cent.

The single country with the largest total drop in student visas issued was Nigeria, due mainly to economic stagnation and accompanying restrictions on foreign exchange. There were also large declines in the number of visas issued to students from Brazil and Russia.

10 countries with the largest net decline in Tier 4 and equivalent visas issued to main applicants, Q1-Q3 2016 vs Q1-Q3 2015

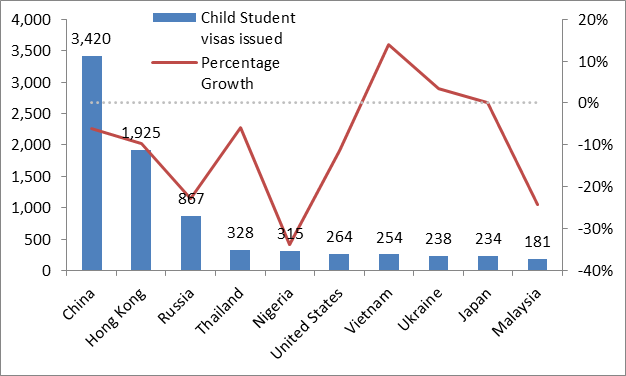

The numbers above include both general Tier 4 visas and Child Student visas, but not Short-Term Student (student visitor) visas. Breaking the numbers down by sector, the number of Child Student visas declined significantly in the first nine months of 2016, falling by 9.4 per cent overall. Many of the largest sending countries at this level saw major declines, including Mainland China where the number of issued Child Student visas fell for the first time since this visa class was introduced in 2009. The reasons for this are still unclear, but could suggest a fall in the number of new Chinese students enrolling in UK independent schools in the 2016-17 academic year.

10 countries with the largest number of Child Student visas issued to main applicants, Q1-Q3 2016, and growth vs Q1-Q3 2015

Source: Home Office.

Overall, the decline in Tier 4 visas issued to students from many major sending countries, coupled with continued strong growth in Mainland China, has increased the UK’s reliance on the Chinese market. The country accounted for almost 41 per cent of all student visas issued in this period, up from 37 per cent last year and 23 per cent five years ago. This makes China six times larger than the next largest sending country, the US, in terms of issued Tier 4 visas.

Add new comment

Please note that comments by non-members are moderated. They do not appear on the site until they have been approved. Comments by registered members appear here immediately. Your email address will not be published. All fields are required.